M&S shares jump 20% to two-year high after profit upgrade – business live

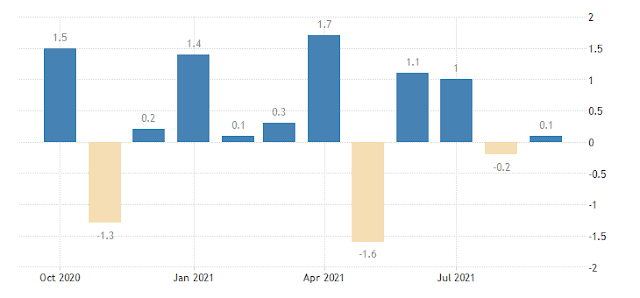

There’s good demand, but Italian producers seem to be meeting increasing supply-driven obstacles. This will likely limit the scope for a substantial industrial contribution to the country’s GDP growth in the coming quarter.

Looking ahead, evidence from recent business confidence surveys points to a continuation of the current production pattern. The combination of strong domestic and foreign orders and declining inventories is, in principle, a good best omen for higher production, but businesses are also signalling that materials and capacity are increasingly hampering production.

Even assuming that some businesses managed to hoard intermediate goods and commodities, longer delivery times suggest that that might not have been enough to meet growing demand.

Furthermore, even though demand is not yet perceived as an obstacle, the vulnerability to supply disruptions of Italy’s main trading partners might eventually negatively hit Italian producers. Germany, Italy’s premier export destination, is a case in point, with Italian car subcomponent producers clearly exposed to the risk of production stops from chip scarcity in the car industry.

The bottom line is that, notwithstanding the notable resilience in manufacturer confidence, we believe that temporary factors will limit the scope for a solid contribution of industry to GDP growth over 4Q21. Add to this some cooling down in services on the back of Covid-19 concerns, we will likely end up with a clear deceleration of GDP growth over the coming quarter. We are currently pencilling in a 0.5% QoQ GDP expansion in 4Q21, which would still leave the average Italian 2021 GDP growth at a comforting 6.2%.

|

It is M&S's subsequent benefit redesign in 90 days, and just the second this century. AJ Bell speculation chief Russ Mold said:

Something staggering probably occurred since August for Marks and Spencer to redesign profit direction by and by. In those days, it accepted pre-charge benefit for the year would be over the upper finish of a formerly directed £300m to £350m territory. Presently it's discussing benefit hitting £500m which is very some leap.

Food deals are doing unbelievably well, especially instore. It has truly nailed the suggestion with respectable quality items and an always broadening scope of things. Quality is the catchphrase as it provides food for a particular kind of client who is glad to pay that piece extra for something decent.

Its web-based joint endeavor with Ocado has likewise helped the business contacted a more extensive crowd, for example, people who need greater items however don't need the faff of visiting a store.

Be that as it may, clothing keeps on being a hodgepodge, he said, albeit the organization seems to be more sure with regards to its possibilities.

By and large deals aren't developing yet working benefit is, because of selling more things at the maximum.

Imprints and Spencer has gained notoriety for being the spot you get you underpants and socks, or maybe push the boat out and purchase a pastel-hued sweater. However that isn't sufficient to support an appropriate dress business.

Suits and formalwear have been pushed aside and more floorspace given to athleisure, leggings and pants. The main issue is that such large numbers of its clients are old and don't have any desire to wear splashproof running bottoms. The organization needs to draw in a more youthful group and it could consume most of the day to change its picture as the brand is as yet connected with shoes and socks.

Commentaires

Enregistrer un commentaire